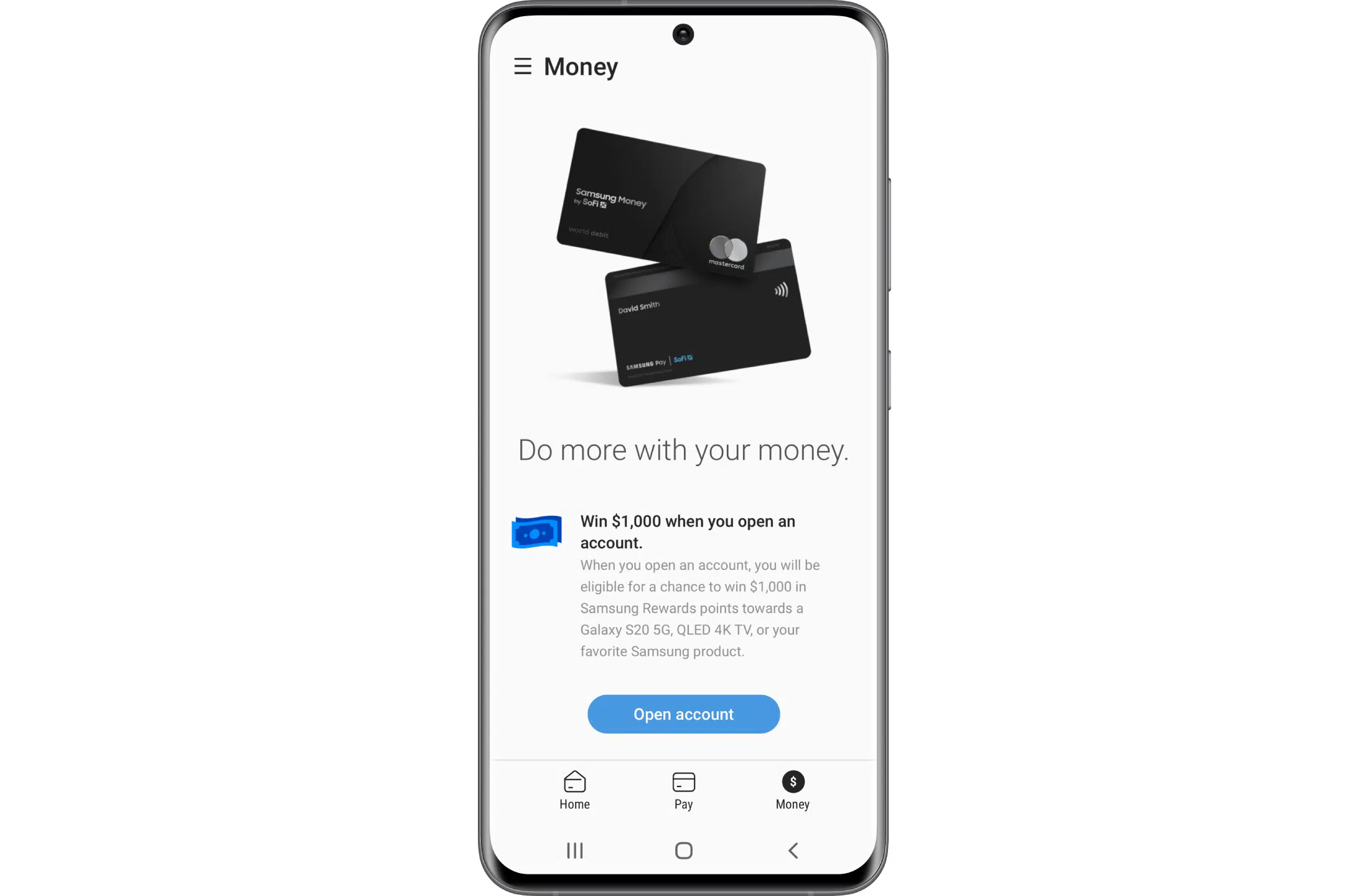

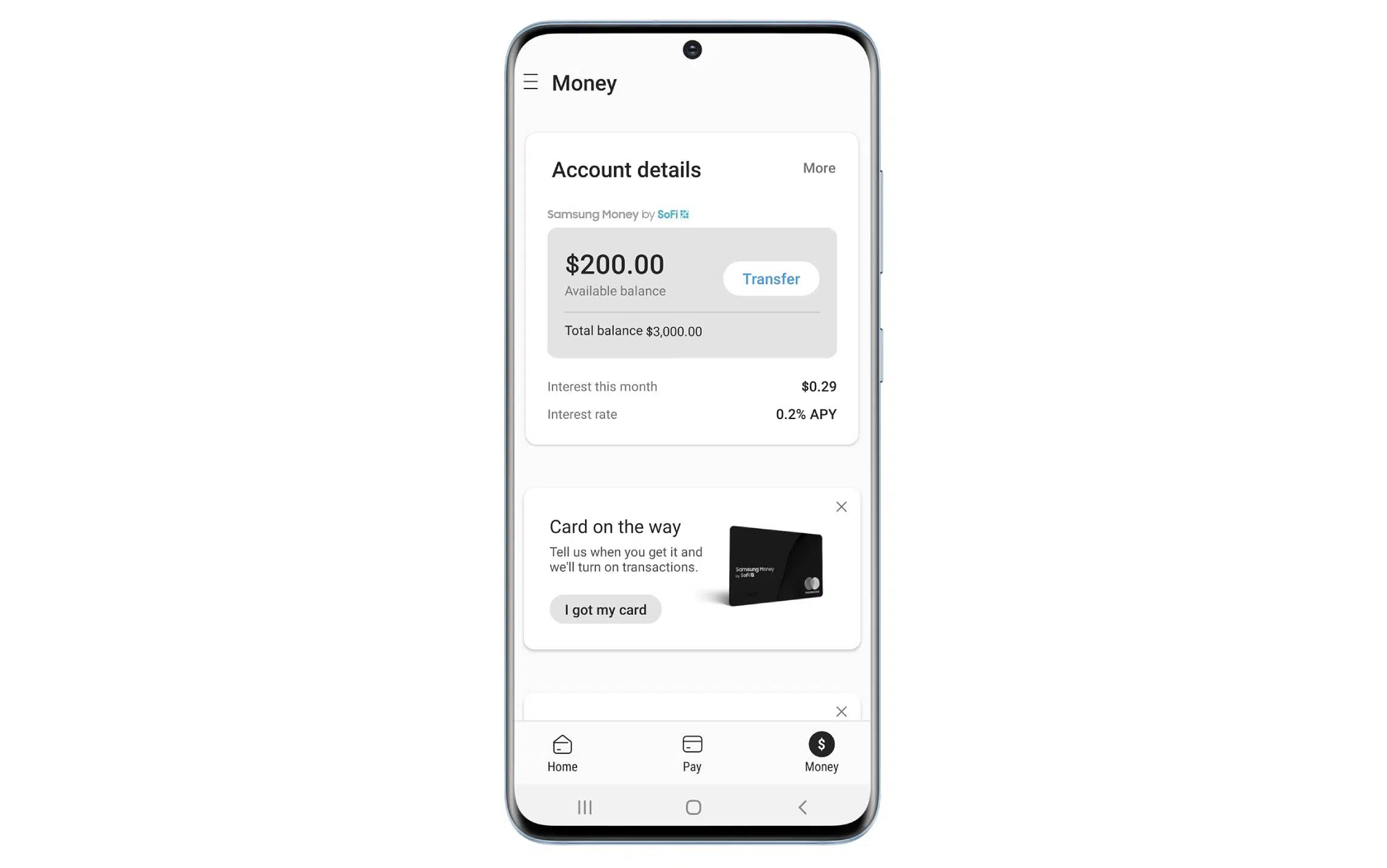

Today, The Korean tech giant Samsung has introduced Samsung Money Debit Card, a SoFi-powered “Money Management Experience” combining a Mastercard Debit Card issued by BanCorp Inc. with an immersive cash management account. It also securely integrates with Samsung Pay. With Samsung Pay, you receive your virtual credit card just after signing up, and can activate the physical card by tapping it, states the Samsungs Newsroom. You can check your account balance, mark potential transactions, freeze your debit card, and almost control your account from an app.

As the Samsung Newsroom suggests, Samsung will reward points for every purchase you make with the card using Samsung Pay, and “loyal” users with over 1000 points can convert them to cash. Like Apple Card, Samsung’s physical card doesn’t include the card number, CVV, and any other details that thieves and scammers could use.

As with Apple Card and Google’s upcoming Debit Card, there is some visible strategy. With Money Debit Cards, Samsung will be expanding its services in mobile when smartphone sales are slowing down. Samsung has not specified the revenue that Samsung will directly collect from Money.

Unlike Samsung Pay, Money is a substantial financial commitment. It’s not certain that many people will want to trust Samsung with their finances or lock themselves into buying its phone — Apple’s credit card is linked to a unique platform, while Samsung is one Android vendor.

Launching later this summer, Samsung Money marks the beginning of a new partnership between Samsung and SoFi. As leaders in mobile and financial technology, Samsung and SoFi shares more convenient for people to take more control of their financial lives.

“At SoFi, we’re committed to helping people achieve financial independence both directly through the SoFi brand, as well as indirectly, through partnering with leading brands like Samsung to help the world get their money right,” said Anthony Noto, CEO of SoFi. Samsung Money by SoFi will be available in U.S. consumers later this summer.